We are $ 4 Trillion Special

Today the post is a copy of our previous post on February 5, 2014, a time that in retrospect is almost the exact time when the market top formation started.

We are $ 4 Trillion Special

We are in a global world. Something like 50 percent of S&P 500 earnings are offshore. The US has been managed by a FED that has focused on throwing a lot of funny money at domestestic entities, and we have seen that most of the effect has gravitated to US asset prices rather than the real economy. But the real issue, how in a global world can one country be so out of balance with the other countries? We are always told that what one sells someone else has to buy.

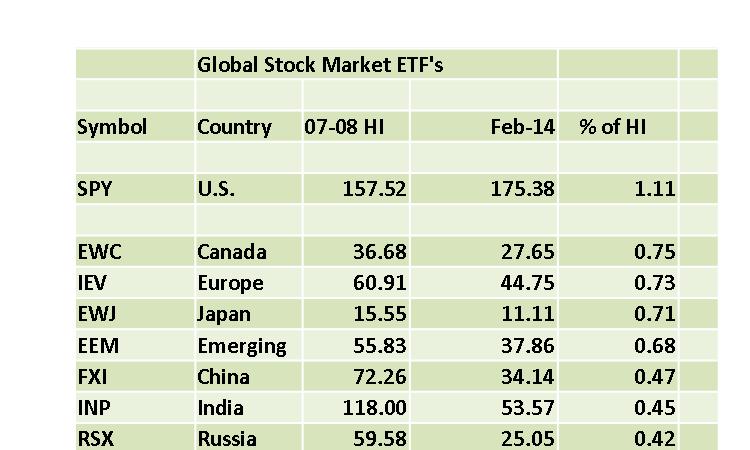

So US investors have been very special, $ 4 Trillion Special of funny money special. The enclosed chart shows the highs on stock market ETF’s in 2007-2008 in various countries and the current prices. Note that the US is the only one that is higher. On average the stock ETF’s of the other countries are 58 percent of the 2007-2008 highs. For the S&P 500, a value equal to 58 % of the 2008 highs is 918.

So there will be a lot of talk tomorrow about emplyment numbers and whether the taper will come off if there is a bad number. But you can see from the numbers here, that is not the issue. The issue is that the funny money is not bringing us back to 2007 in economic vigor. Until core asset values around the world drop to levels where growth can spark, we have more to do.

Today the post is a copy of our previous post on February 5, 2014, a time that in retrospect is almost the exact time when the market top formation started.

Leave a Reply