A Contrarian 2022 View 3.0

For the front page I captured this recent blog post.

Eureka Perspectives May 21, 2022

This morning I am looking through some of the charts I keep for analysis purposes. They are part of my approach where a mix is used of maybe 70 percent outside-the-box long term thinking combined with maybe 30 percent short term timing reality.

First here are some overall points to color the page.

- Interest rates appear to have normalized.

- the number one goal of the FED is to try and correct their mistakes, the huge FED Balance Sheet, and the cheap rates that stayed around too long.

- It is sad that the main method they are using to fix the mistakes is to try and destroy demand by crushing the economy. The other two factors in the equation, supply and inflation, are outside their control. So we will see how this plays out.

- Oil prices are the wild card at this point and they are highly motivated by speculative FED Balance Sheet liquidity and the Ukraine War.

Chart Thoughts…

Next, I will just number the chart thoughts as they jump out to me as I page through them.

- It is difficult to make an overall comment about what interest rates suggest for the economy. This is due to the fact that the FED is playing a game with short-term rates and forcing the other rates to guess what comes next. While this would be novel, since the FED created the problem with its mistakes, what if the FED raised the 3 month rate to 3.00 percent at once, then we could see how all the other rates would react and see what the economy really thinks.

- We have seven trading models that I follow. One has turned positive on stocks this week (this model weights gold more than the others and tends to give buy signals when the medium term trend for gold is negative). The other six models are still bearish on stocks. I like to be early so guess which of the seven I am following.

- The October 2018 interest rate level seems to be resistance at the moment with mixed messaging, the 30-10 YC says rates have topped for this cycle, while the 10-02 YC rates are saying be patient.

- Commodity prices other than oil have gone up a lot since March 2020 cash injections into the economy. Here is an index chart I keep of food and manufacturing input prices, index made up of corn, soybeans, wheat, copper, and aluminum futures prices. What is interesting is that these input prices topped in June of 2021 and have dipped slightly since then. Much different than the oil chart.

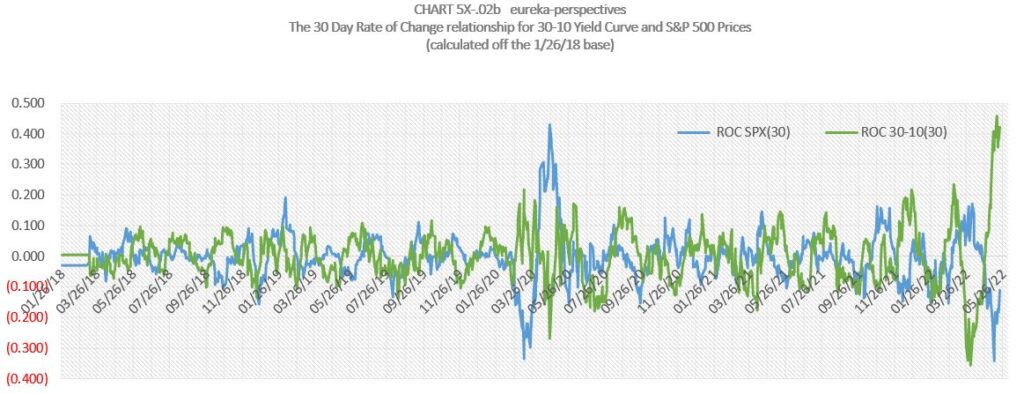

5. I have always liked my 30 trading day rate of change chart for the 30-10 yield curve rates and S&P prices, even now when I don’t trust rates to have much information embedded in them. While there are a lot of smaller moves indicated on this chart, I like to focus on extreme events. In the last couple of years we have had two of these extreme rate of change events on the 30-10 Yield Curve, one was on March 12, 2020 and the second was this week, May 16, 2022. The March 2020 signal yielded a 16 percent increase in S&P prices over the following 30 trading days. We are in the trade and will be watching this closely. The Green line is interest rates, and you can see this extreme is well above March 2020, the blue line is SPX prices.

Time for Lunch.