Watching the Clueless Adjust

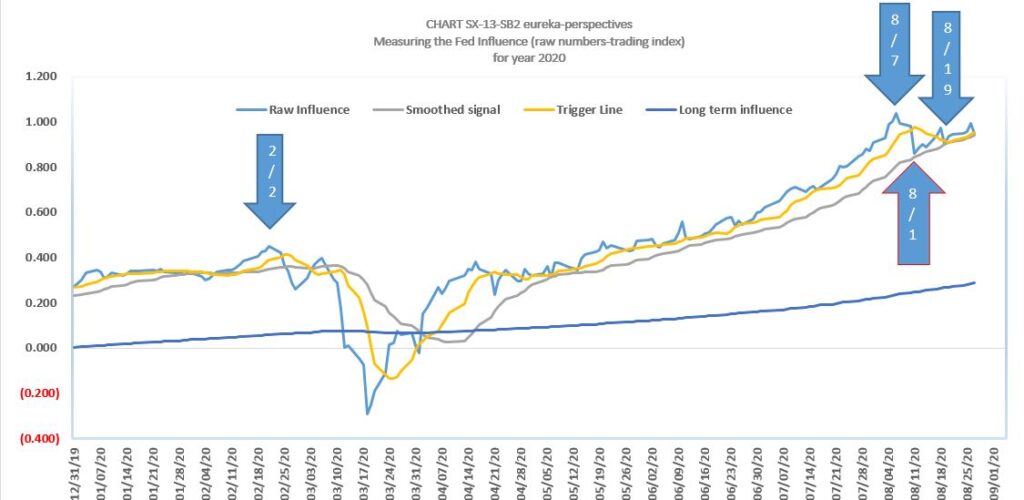

Back on August 7, 2020 we outlined that the Macro Picture had changed for some reason. We cited two key factors to watch, interest rates and the political picture. We also pointed out that the data pointed to something going on that would change a 40 year pattern of the markets.

Today we have a Clue..

That clue was FED Chairman Powell’s Jackson Hole speech. It was much anticipated and the text was broadly reviewed for a few weeks. But, until he spoke everybody watched although the underlying changes were starting to become visible since August 7.

And that clue is a macro change in interest rate policy, and what is really interesting is that the CNBC take on the change is that this means cheap interest rates forever, they could not be more wrong. What it really says is that interest rates are really going to be a function of economic action (not necessarily growth, could be debt problems) but not employment levels.

And why is that important, FED reaction to the COVID Pandemic has been to add a huge amount of debt and that is gradually going to change long term interest rates once the economy gets past COVID and tries to get back to some version of normal. The first clue today is coming in the TLT Bond ETF and rising long term rates.

This may be why we said back on August 7th, we are spotting a change in 40 years of economic direction.

So Who Is Clueless ?

The CNBC/Robinhood crowd who buy the low interest rate / high stock price story.

Here is an update of the chart we first showed on August 7. The S&P was around 3500 when this reading was taken. We have not yet seen the trigger line cross the signal line, but it is close and headed down.

Leave a Reply