The Fang / Nasdaq Dilemma

A Special Report:

Pundits these days scoff at talk of a massive, maybe 40 to 70 percent decline in stock prices in the coming year.

A look at the FANG / Nasdaq stocks illustrate how easy that could happen. All it would take is a few pension fund managers deciding that they had better lock in some gains.

I monitor four groups of Nasdaq stocks, not because I trade them, I don’t, but I do watch them for the story they tell. In a classic sense when you listen to commentators talk about them you see this is a “they don’t know nothing game”. These stocks have gone up so much that there is no reality anywhere nearby. The charts I will present here were started when Mnuchin and the Treasury started supporting junk bonds in April of this year and speculation took over the markets. Currently there seems to be a general consensus that there could be a ten percent decline in the first quarter of 2021 but that will be no big deal. And, when you look at the charts you see why that is, ten percent down doesn’t come close to scaring anyone, it would take much more.

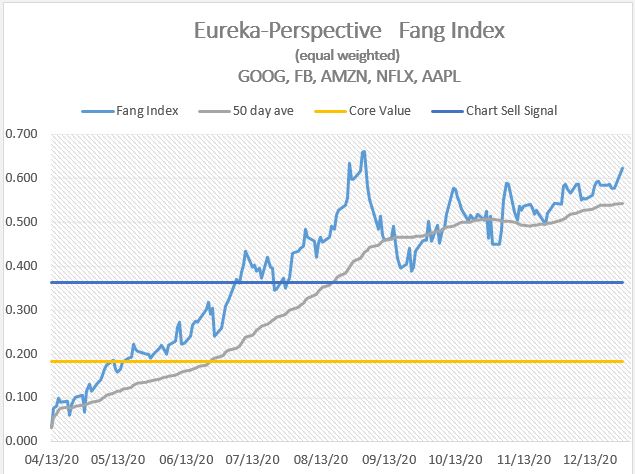

The first group I monitor is the familiar FANG stocks, and interestingly they are closer to reality than many of the other stocks at the NASDAQ, But you see they are up 60 percent since April and using classic chart analysis on the individual stocks, their first minor sell signal is some 23 percent lower and the first core support is around 45 percent lower.

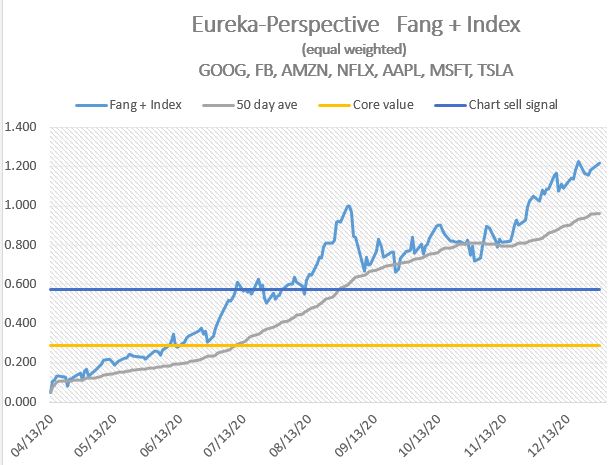

The second chart is for what I call the FANG + stocks, all 5 fangs plus Microsoft and Tesla. Due to the Tesla effect they are really stretched so on average their first sell signal would be around 60 percent lower and core value is around 90 percent lower.

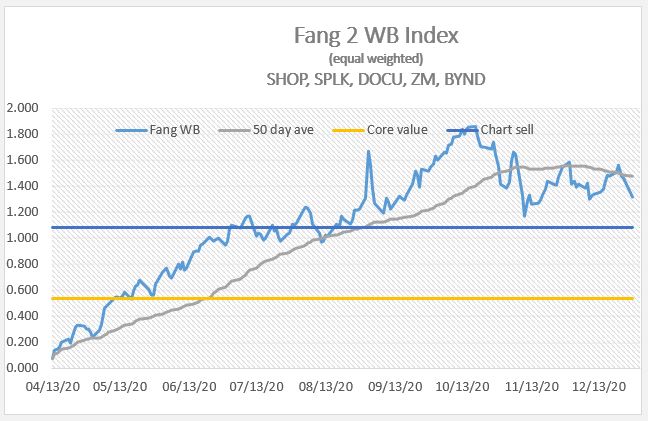

The reason I decided to present these charts tonight is due to what happened to this next group of stocks today. This group I call Fang 2 or for fun, the “wanna bee” Fang stocks. They topped out in mid-October and over the last couple of days started showing real weakness and are approaching a first sell signal.

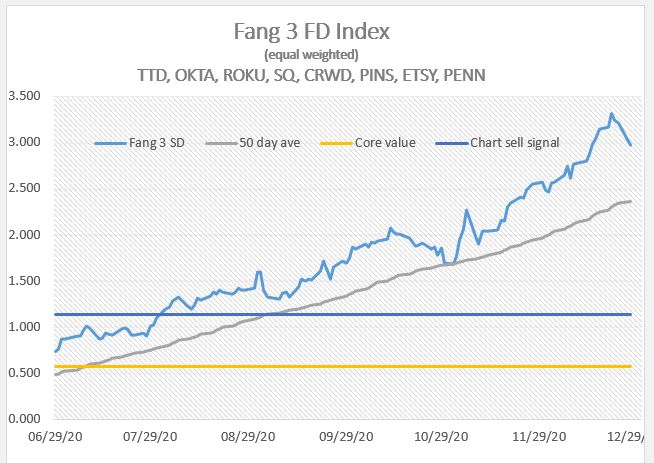

And then lastly, here is a group of stocks that must be Robinhood types as they are totally out to lunch in terms of valuation. I call them Fang 3 “Fang Dreamers”. COVID has been a factor in their performance reportedly.

Leave a Reply