Stalemate

Today, and maybe the condition continues until a couple of days after next week’s FED meeting, the market has entered into a state of lethargy. Stocks got crazy earlier in the week, but have bounced a bit and now are sitting and waiting with a few weak sectors still taking pressure. Of course Ukraine is the background noise.

Macro Picture…

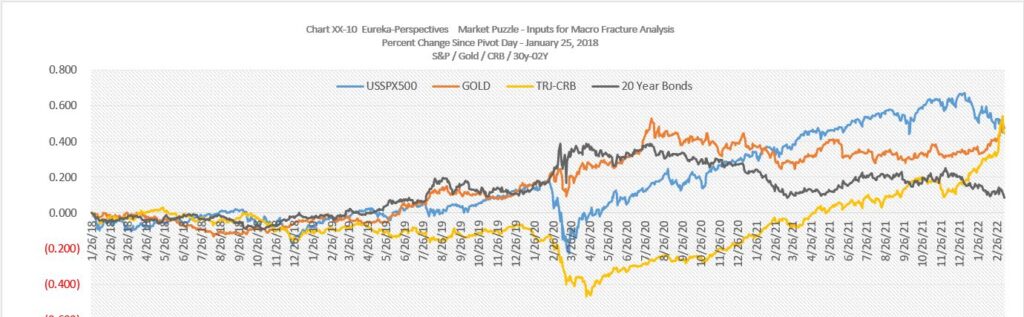

I like to use periods like this to look at the Macro period, and for this representation I will show a chart that goes back to what I call the Fracture point of January 26, 2018. That is the date that you will recall that I use as the base date, the date at which Trump’s Tax and Tariff experiment disrupted the market in a fundamental way.

To that review below is a chart that shows the percentage change from that date for S&P 500, Gold, Bonds, and Commodities. The result is that we see the S&P, Commodities, and Gold values coming together and with Bonds trailing. If I don’t think about reasons, but just take in the chart, I would have to say that the one line that bears watching is bonds, will they climb to enter the stalemate area. Would not that make a few people curl, that interest rates might decline from here. So I am watching, Funny money is holding up stocks. Commodities / Oil have caught up to the other areas and are probably out of gas. Gold anticipated this rise over the past four years and can now take a break. And a weakening economy could pull interest rates lower.

Leave a Reply