When is the Blowout, Why not Soon ?

We are living in a time where the breeding grounds for parabolic moves are multiplying.

Interest rates and dollar value could be next. At the moment there seems to be underlying sentiment that the dollar up move over the past few months is temporary and likewise the interest rate rise that we have seen over the same period are not going to hold.

Why would anyone think that?

Why would not the unthinkable happen?

Interest rates go Parabolic and bonds drop below 100.

Dollar screams higher, retesting the highs seen over the past 10 years, well above 100.

I have no idea of the probability of either of these events, but the unthinkable has been happening with stock prices, why should anything else be different.

See two charts here with red circles for the unthinkable areas.

While this develops, we in the very short term are seeing a bit of movement of money out of stocks into bonds and short dollar.

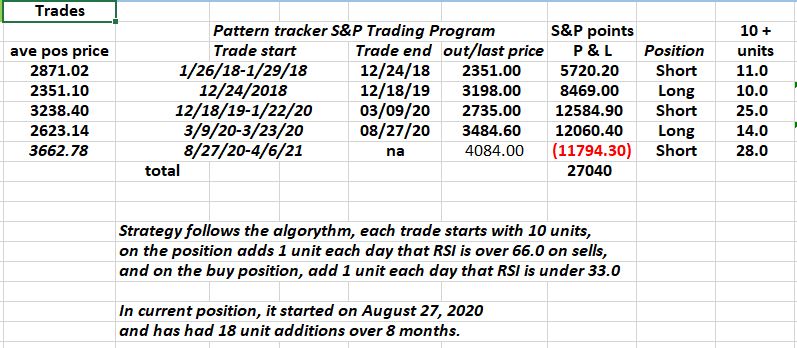

Yesterday and today we saw the RSI over 66 on the S&P , so we now have added 2 more short units on the S&P, bringing the total to 28 units of short S&P with an average price of 3662. Since January 2018 the model has had 5 trades, the current one being the first loss, but it is not all over yet. The net total S&P unit points is however very positive at 27.040 points.

Here is the summary table:

Leave a Reply