2011, a missed teaching moment

This website was started in early 2008 as I saw an economic scenario building that was not sustainable. The great recession that grew out of that scenario caused a lot of pain. It could have been a time to put together the building blocks for an economy that works for all. After the initial saves, post crash, the country had an opportunity to start over.

But what happened?

The problems were papered over and cheap money was replaced by even more cheap money. This direction has not stopped, a succession of FED chairs, stating with Bernanke, and then Yellen, and Powell have only increased the risks.

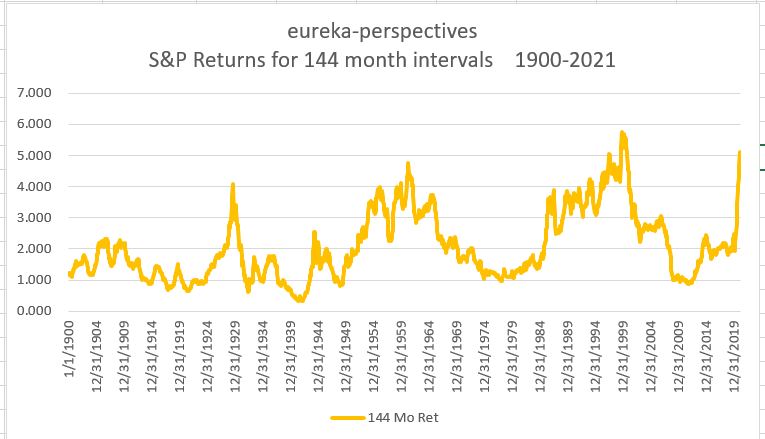

Here is a chart that shows S&P 500 stock price interval performance. Interval analysis is used to determine the start and end of market moves and is important now. We all need to see where we are.

What we see here is that have had four runs in the economy since 1900: 1921-1929 “the roaring 20’s”; 1942-1961 “post WWII”; 1978-2000 “Volker Growth”; 2011-2021 “Bernanke Overkill”. Chairman Powell is an asterisk to this last move.

Further analysis illustrates that the 2008 great recession and 2020 pandemic don’t really register as significant? But what is significant is the FED and what it started in 2011 and never stopped.

Bottomline, the current move is about over, may be over and the talk of a new “Roaring 20’s” is not grounded in facts, look at where the chart value was in 1921 and compare it to today.

Leave a Reply