Next Bull Market Top, Year 2050 to 2070

The euphoria and mania surrounding todays markets are in my view, characteristics of a recession rollover.

Trading or investing with a defensive posture may have seemed brutal since last August but with all the hope injected into the pandemic and election actions, what else could we have expected.

First lets take a look at some background economic cycle factors.

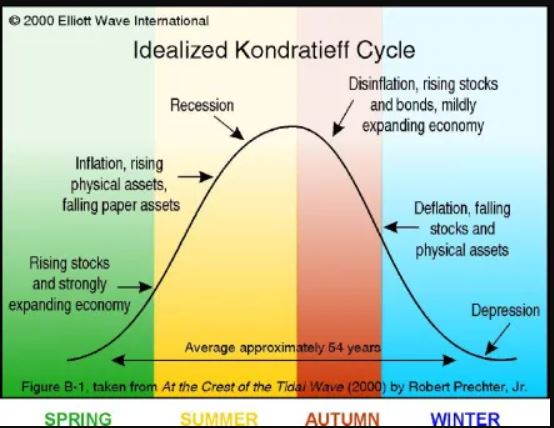

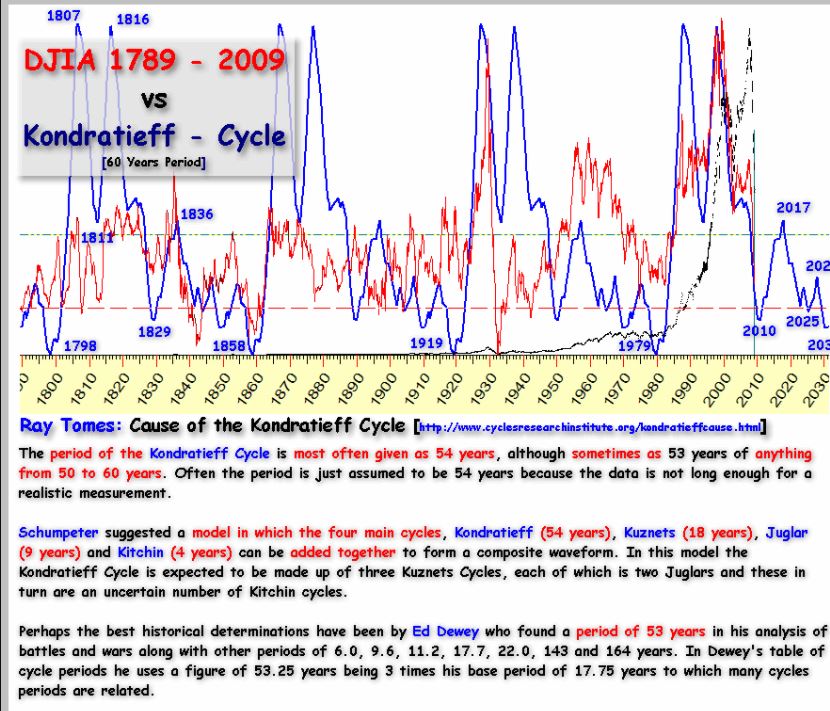

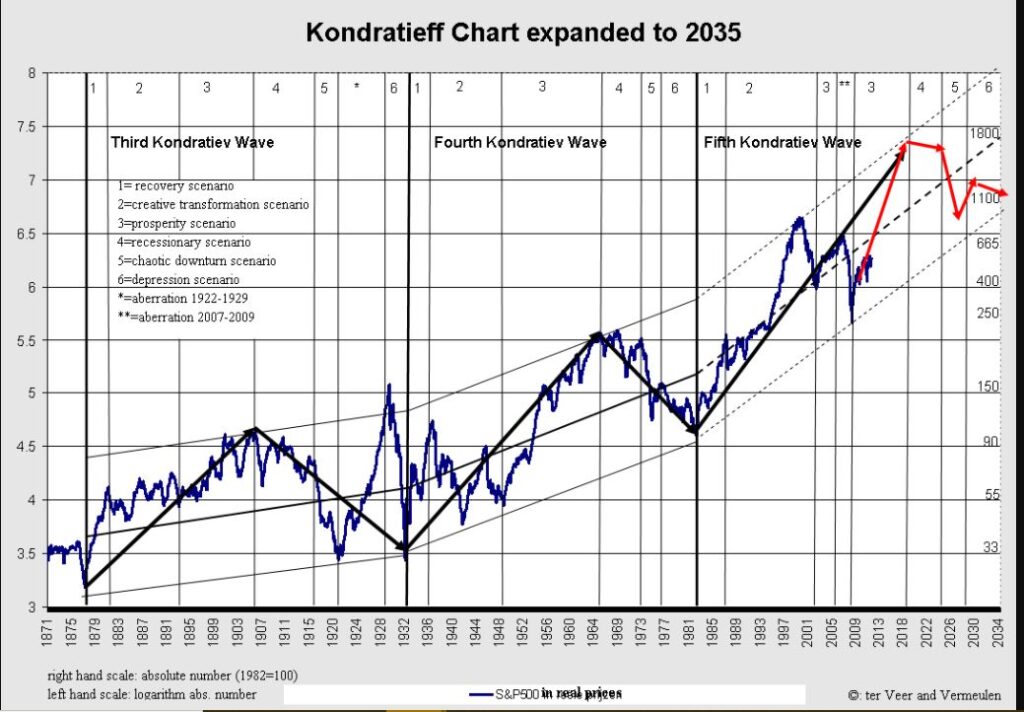

I periodically mention the 18.6 year, generational cycle, that that I follow. It to me is a subset of the longer 54-60 year Kondratieff cycle that many analysts track. Like all cycle work, it is not precise by any means and can put one in short term market pressure situations, but in the longer term it all seems to work out. Here are some background items and charts from analysts that give some history and current views.

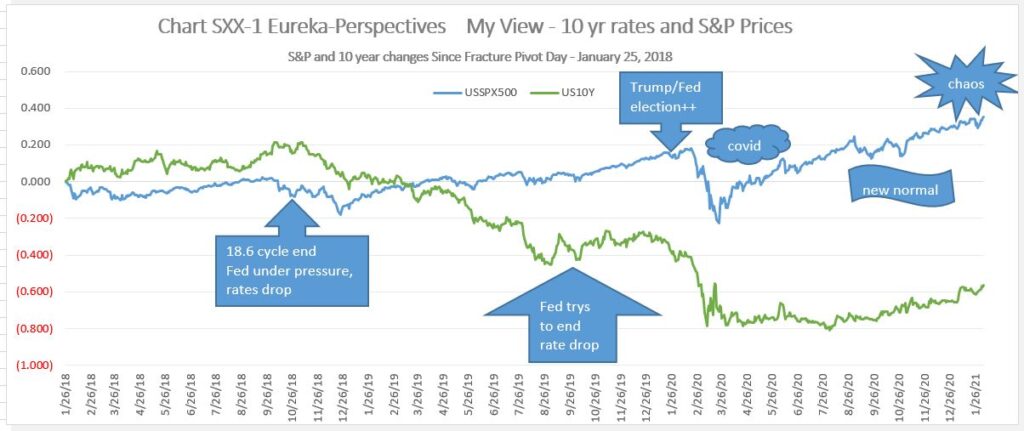

When you put all of this together you can see a pattern pointing to a year 2030 to year 2035 low point before the next major bull market topping in 2050 to 2070. So a lot can happen in the meantime, but I try to think about general macro direction. Year 2008 was a short term high point, and year 2018 could have a high point, but as you will see from my comments in the next section, a lot of market manipulation was involved with a President who thought nothing of threatening and interfering with the FED.

So, How did we get Here?

Here is a chart that tries to present a picture of what has transpired in the stock market since what I call the January 2108 Economic Fracture date, a prelude to the October 2018 18.6 year cycle date and the activity surrounding 10 year interest rates.

What Happens Next?

Anyone who has been running a defensive program is beyond predicting a point where all the current euphoria ends. This market has a life of its own in the short term. Tomorrow we will talk about a couple of inputs that can help with short term posturing.

Leave a Reply