More talk of Deflation

For the past few years we have pounded the desk concerning deflation risk. In the meantime the FED became like the Pied Piper and now has a whole flock of investors following it.

Maybe an outside source of deflation talk will make sense.

http://www.marketwatch.com/story/could-we-be-heading-for-deflation-2014-03-11?pagenumber=2

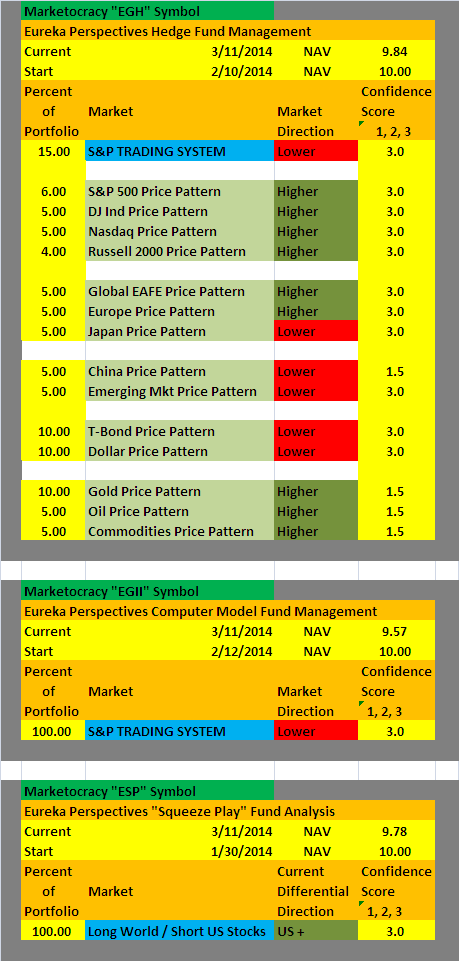

Our market screen seen below shows how the players in the US markets are heavily loaded towards long US stocks, short US T-Bonds, and short the Dollar. Watching this scenario unravel should be interesting.

At the moment our S&P Computer model is the only aspect which is picking up the underlying conditions and it has paid a little entry cost in following that signal. The NAV is down 4.3 % since the EGII Tracking Fund opened on 2/12/14 using a 2:1 leverage ratio on its position.

For the casual market observer it would appear from the charts that it would take three closes bel0w 1849 to trigger anything decisive.

Leave a Reply